Going to start of with something I noted briefly (and with a hand-drawn chart) on Bluesky earlier this week: the recent decline in JOLTS measures has been huge. Like great-recession-huge:

Let’s draw some of the equilibria and put it on a log scale (the “correct” view per the DIEM1). The difference between the pre-pandemic equilibrium and the current estimate of the one we are approaching is comparable to the Great Recession. If you measure from the top of the stimulus peak in 2022, they’re almost exactly the same size.

What does this mean? While the level of the job openings rate is higher than most of the pre-Pandemic equilibrium period — given the whole “vibes-cession” discussion — I can’t help but think people might not be attuned to the level. It is also true that we just left a period of relatively high inflation. That inflation is over and has been for awhile now:

In fact, that inflation has been over since around the time JOLTS started to fall2. And while people complained about inflation while it was happening, the vibes-cession zeitgeist felt later. Maybe it wasn’t?3

Regardless, there has been a huge shock to JOLTS measures. Here are quits and hires rates:

This hasn’t manifested as a major increase in the unemployment rate (though JOLTS declines have preceded an unemployment rise in the past):

While the shock to JOLTS has been huge, the shock to unemployment has been tiny (“the littlest recession”):

The magic return to the pre-stimulus dynamic equilibrium has been the most puzzling — is it an example of a restorative force? Regardless, it does seem like a good bet going forward. The current path seems likely to merge with the expected level after the pandemic in the counterfactual of no stimulus shock4. In contrast, JOLTS job openings has exceeded this heuristic — openings are well past the no-stimulus counterfactual, “over-correcting” by about 100%.

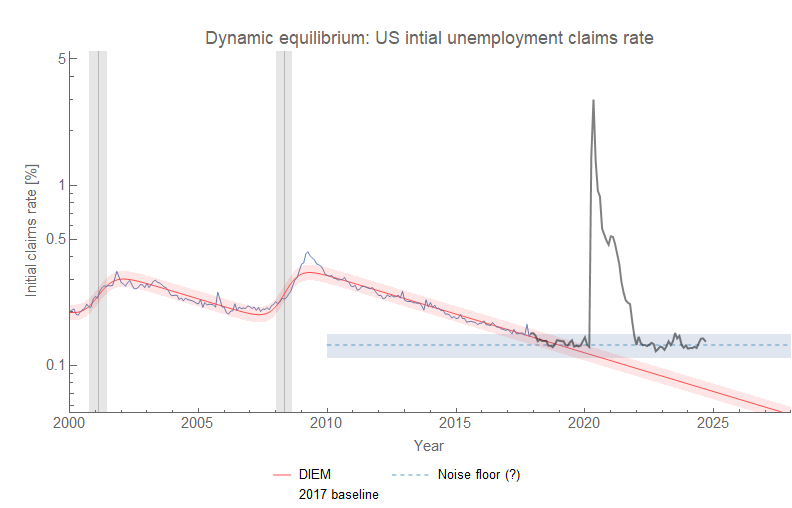

Initial claims continues to be (hypothetically) useless — riding at the noise floor since early 2022:

So those are my big takeaways from Jobs Day September 2024: JOLTS shock = huge, stimulus information = evaporating, and initial claims = useless.

Update +15 minutes

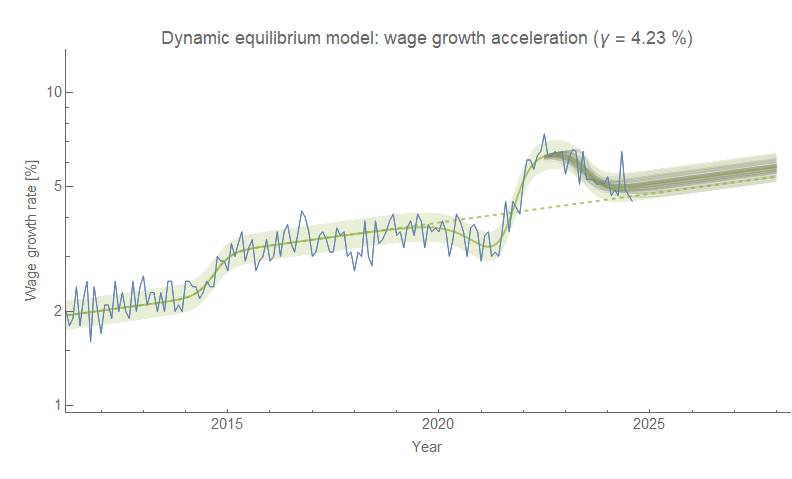

Forgot the wage growth model! Unlike other labor market measures, wage growth appears to be heading back to the pre-pandemic equilibrium:

Dynamic Information Equilibrium Model. It is based on an assumption that a process variable A is growing (or declining) ~ exp(a t) for some a on average.

Still kicking myself over the fact that I did have a chance to forecast the rise in inflation based on my “gravity waves” hypothesis that major changes in labor force participation (WWII demobilization, women entering the workforce, … post-pandemic return to work) are associated with spikes in inflation.

I don’t really know anymore as every year since 2016 has been ridiculous.

I call it the stimulus shock, but that’s mostly as a label. The shock appears as soon as the Biden stimulus does and lasts from early 2021 to the end of the year. It might not be stimulus. It might be vibes. Maybe everything is vibes.

So the gravity model suggests that big LFPR changes *in either direction* cause price-level/inflation-rate increases? !!

Why use series sans seasonal adjustments?