JOLTS Update 2023-02-01

Negative shock estimates seem to be converging on a relatively small shock ... or a return to the 2017 equilibrium? Plus, updates for unemployment.

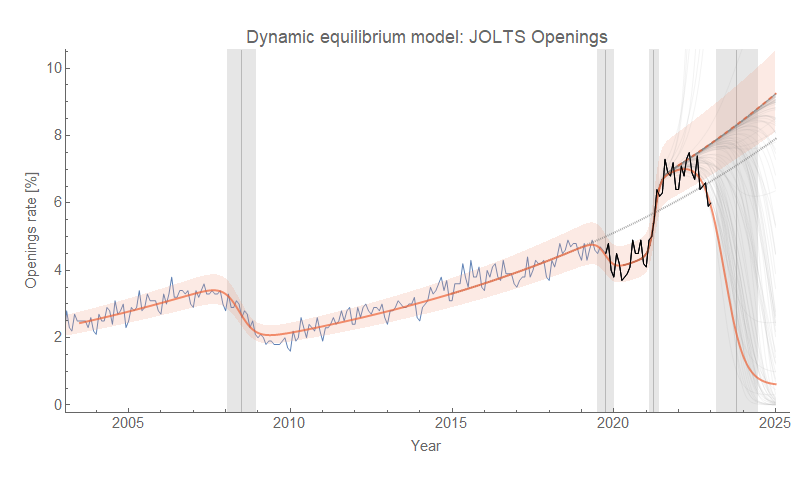

Along with JOLTS job openings (above), hires and quits all seem to be returning to their pre-2017 equilibrium. These measures are all correlated, so it’s not really independent information for all three to return. However, the return remains interesting — as if there is an underlying equilibrium to return to that was only temporarily affected by the pandemic and re-opening.

In these graphs, the gray forecast path band represents hundreds of paths from a Monte Carlo based on the (co)variance in the estimated shock parameters. This cloud had already tightened up for quits and openings, but is now tightening up for hires.

Here are quits and hires:

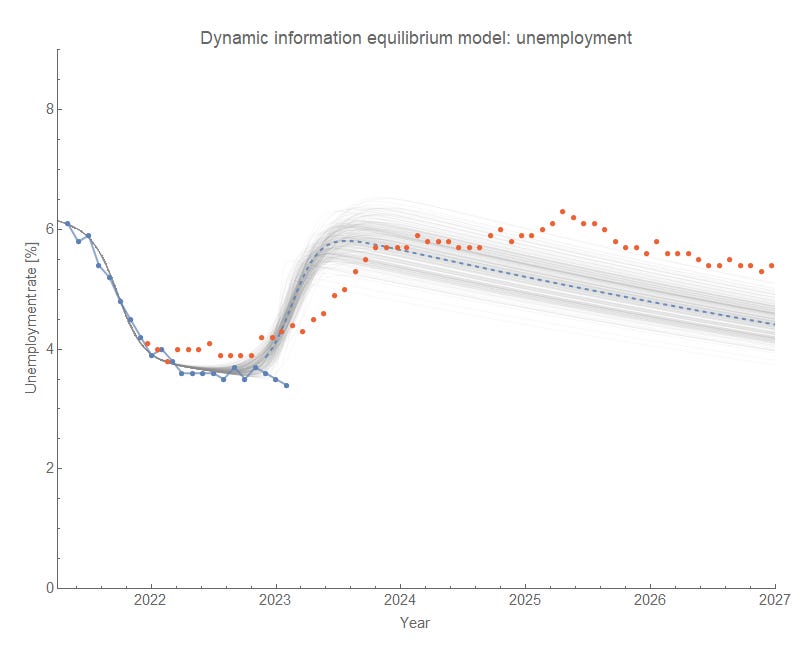

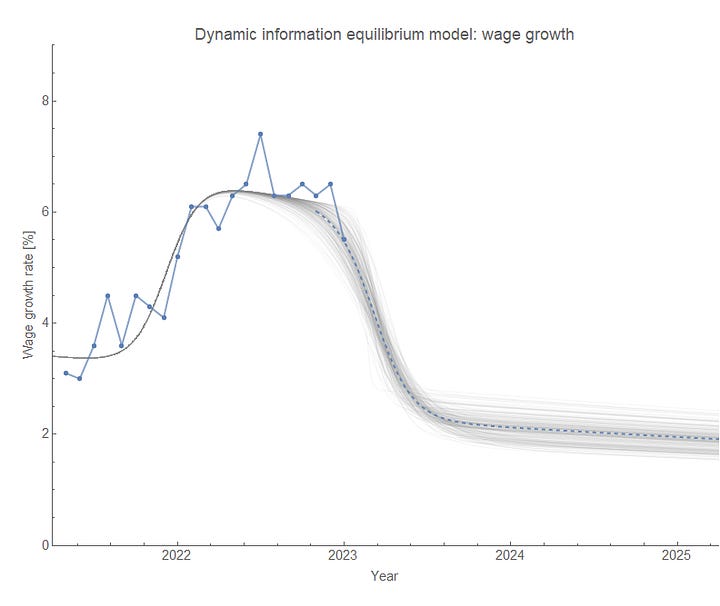

If we use the hires data to forecast unemployment and wages we can see the unemployment rate is not rising as expected, but wage growth is falling as expected.

That fall in wage growth was apparent in new quarterly ECI data from yesterday as well. We’ll get a new initial claims data point tomorrow (potentially still at the noise floor) and a new unemployment rate data point at the end of the week (I’ll update this post with that data when it comes out). I’m expecting it to rise based on the models, but as mentioned before the lag might have a higher variance for unemployment than for wage growth.

Something that is interesting is that there’s no particular evidence the negative shock is ending in the openings data without seasonal adjustment:

I will do an update of the model using the NSA data when I have an opportunity later tonight. It is harder to eyeball the effect of seasonal adjustment in hires or quits.

Update 7:30pm: Here’s that graph. It’s basically completely uncertain.

Update 2/4/23

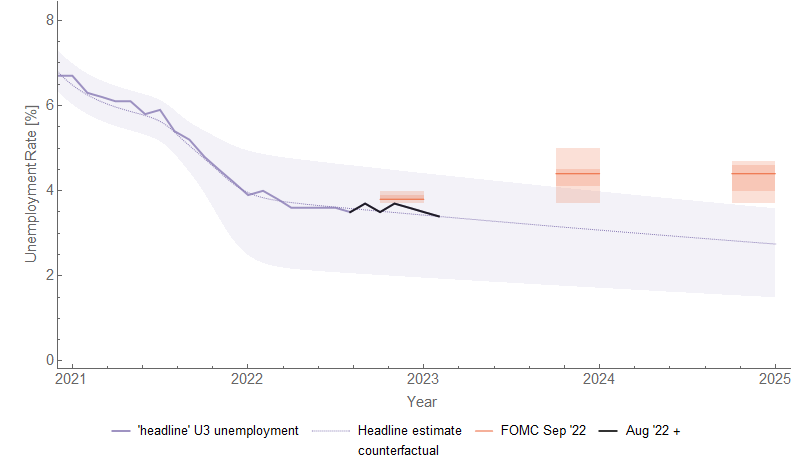

Core1 unemployment data came out and is right in line with the DIEM forecast model not just from the August of 2022 update of the shock parameters, but from a year ago for February 2022:

Essentially — no sign of anything but equilibrium. Additionally, headline U3 unemployment is right where it’s expected to be:

This of course means the projection using JOLTS hires to forecast unemployment is not a good indicator (hires → wage growth in the post above is still working):

Several things could be going wrong here such as the lag being wrong or even the shock width being modulated — i.e. when a shock goes from hires → unemployment the width increases. There’s some possibility of both of these if we look at the 2000s recession compared to the JOLTS estimate. The shocks to unemployment are all pretty uniform with a width parameter ~ 0.3-0.4 year while the current shocks to hires has a width ~ 0.1 year — unemployment shocks are typically three times as wide.

Initial claims still seems to be at a “noise floor” which would mean the fluctuations are meaningless:

U3 unemployment minus temporary layoffs.