Three dimensional thinking

Scott Sumner has a post up where he asserts that monetary policy and fiscal policy represent vectors in the same single dimension rather than separate directions (i.e. alternatives) in two dimensions. This is because he believes in monetary offset (i.e. monetary policy can completely cancel changes fiscal policy) which means that the vector sum of the effect of monetary policy [1] on (for argument's sake) the price level and the effect of changes in fiscal policy on the price level can exactly cancel.

How good of an assumption is this? I think some three dimensional thinking may help here. Let's look at the path of the US economy through the 3D space {MB, NGDP, P} where MB is the monetary base, NGDP is nominal GDP and P is the price level (CPI):

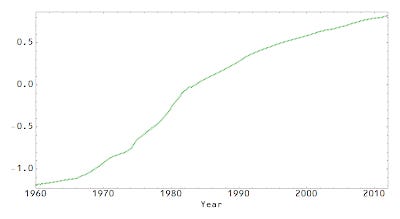

Here is the plot of log P versus time:

If we look at the 3D graph of P(MB,NGDP) from a particular viewpoint we can see that we can reproduce the price level fairly accurately (I've overlaid the two graphs):

The interesting thing about this is that the fit requires us to look in a direction that is neither along the MB nor NGDP axis, but rather a vector in the plane {MB, NGDP}. There are two solutions at this point: one is that log NGDP = a log MB + b (i.e. a variant the quantity theory of money where NGDP ~ MB^a) and monetary offset still applies or that monetary policy and fiscal policy (ΔG) [2] represent two different directions in a more complicated space containing the path of the economy.

UPDATE (title reference):

[1] Note, I do not say changes in monetary policy. We are assuming there is some target and that changes due to fiscal policy are canceled by the expectation that monetary policy will be on target.

[2] NGDP = C + I + G + X - M