The Keynesian part of Abenomics is the part that works

Both Noah Smith and Scott Sumner have drank the Kool-Aid on Abenomics, both crediting the monetary component -- you know, the quantitative easing that doesn't do anything to the price level. Here's Sumner:

Abenomics has raised the price level in Japan, reversing a secular decline.

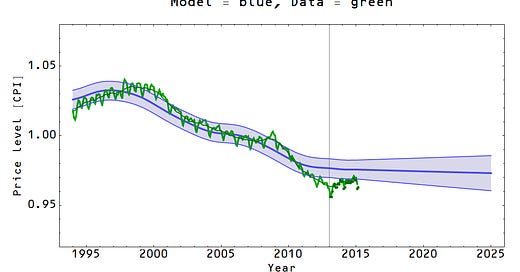

Actually, it looks like a pretty strong claim if you look at the data in a model-independent way:

Right when Abe takes over (vertical line), there is a big reversal in the direction of inflation. But that's a model independent take. Like this (rather hilarious) model independent take on global warming. What happens if we apply some knowledge of how economies actually work?

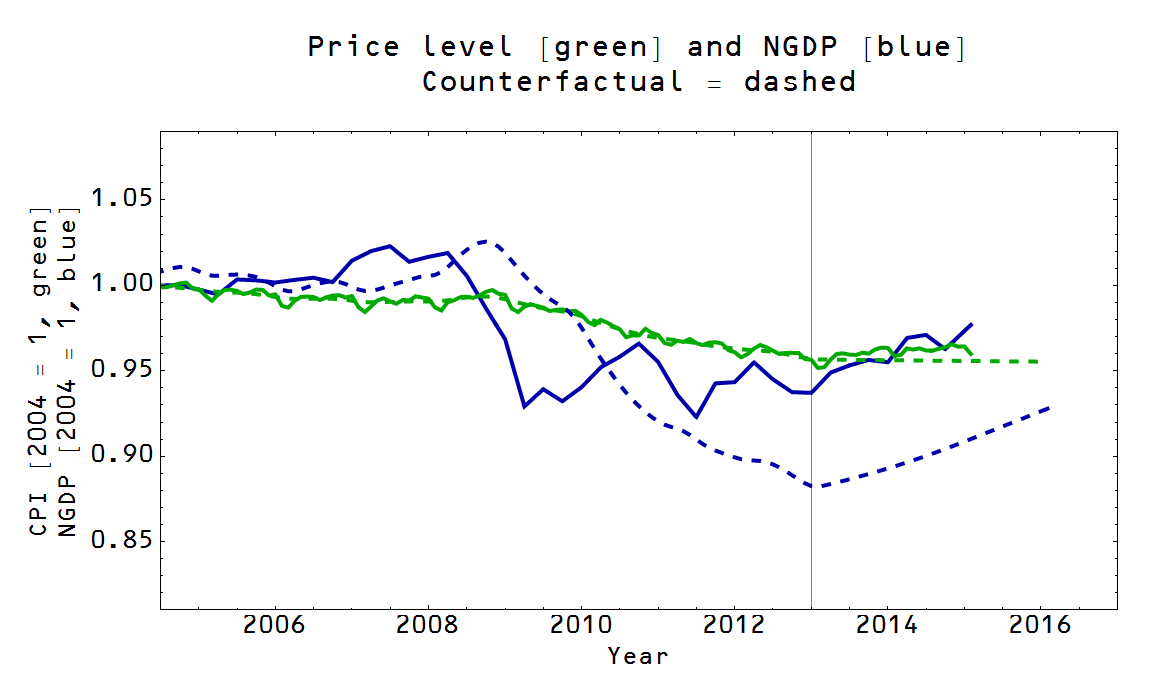

I looked at the required path of NGDP in the information transfer model to reproduce a continued fall in CPI from 2013 onward

In order to produce continued deflation, if NGDP was the only effect, NGDP would have had to continue on its downward trajectory. Now lets look at the difference between this counterfactual and actual NGDP and compare it to government expenditures in Japan:

Actually the reverse seems to have begun in 2008. The financial crisis gave the Japanese government a reason to expand spending -- it had been flat since 2002.

A Keynesian increase in government spending could explain the entire effect -- no need for market expectations, monetary policy or even Abe taking office (he did vow to continue the increase in government spending, so fiscal Abenomics, aka Keynesian economics, works continued to work).

Update 3/31/2015

Commenter LAL asked (below) if counterfactual deflation was smaller, would it lead to similar results. It does -- there is a slight difference in that the same increase in spending leads to a smaller increase in NGDP:

The difference is visible at the end after the vertical line (that is where the less deflation counterfactual differs from the more deflation counterfactual in the post above).