The ITE guide to schools of economics

Modern Monetary Theory = Standard macroeconomics + politics

Post-Keynesian economics = Standard macroeconomics + politics

New Keynesian economics = Standard macroeconomics

Market monetarism = Standard macroeconomics – liquidity trap

Real business cycle theory = Standard macroeconomics – sticky prices

**Information transfer economics = standard macroeconomics + empirical data

...

This was inspired by Simon Wren-Lewis on MMT. Consider that seconded. I did a series on Post-Keynesian economics (and the drudgery that is accounting approaches to economics) here, here and here. My last word on market monetarism was here.

...

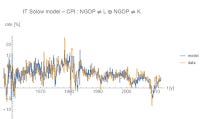

PS None of these schools can do this with two equations and five parameters:

...

Update: This is a choice quote from Palley [pdf]:

The criticism of MMT is not that it has produced nothing new. The criticism is that MMT is a mix of old and new, the old is correct and well understood, while the new is substantially wrong.

I just don't understand why anyone would want to try to fix macroeconomics but be completely uninterested fixing the lack of comparing quantitative models to numerical data. It is baffling. To that end, here is the ITE guide to schools of economics view of empirical data:

Modern Monetary Theory = Ignore empirical data

Post-Keynesian economics = Ignore empirical data

New Keynesian economics = Ignore empirical data

Market monetarism = Consistent with any possible empirical data

Real business cycle theory = Ad hoc trend removal and reproduce moments of empirical data

**Information transfer economics = Use empirical data