Stocks and k-states, part V

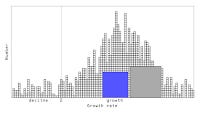

The picture of stock markets presented here lends support to this picture of the financial sector. We can see the distribution of k-states (relative growth rate states) moves in concert during the financial crisis:

This means that, to first order, the financial sector (gray) can experience a shock behaving like an "anti-Keynesian" government sector (blue) where the rest of the distribution represents the entire economy:

The Keynesian government sector case was discussed here.

This was inspired by an exchange between Dan Davies and Noah Smith on Twitter:

@dsquareddigest @dandolfa @AdamPosen @t0nyyates Could you model finance in a more realistic way? And if so, how?

— Noah Smith (@Noahpinion) January 14, 2017