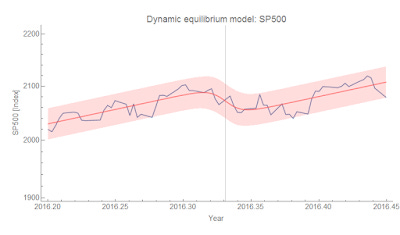

Self-similarity in dynamic equilibrium

Let me say up front I am not saying the idea that stock market price time series are self-similar is new. What's new is that a specific structure (i.e. the dynamic equilibrium + shocks) appears at different scales. Here we steadily zoom in on the S&P 500 from a multi-year timescale, to a few years, to on the order of a year, down to months (discovering new shocks at smaller and smaller scales):