More on the Great Depression

David Glasner has a new post up on the monetary theory of the Great Depression which reminded me that I could do a bit more in the vein of this post. I'm sure the data is probably consistent with several different causal mechanisms. My only (interesting) opinion about the gold standard was that leaving the gold standard wasn't relevant to the recovery, but rather interest rate pegging driving (effective) hyperinflation.

Anyway, I grabbed the FRED series A08170USA175NNBR (non-agricultural employment 1900-1943) and tested the model that nominal shocks were proportional to labor supply shocks (that I talked about in this post)

In fact, the GNP data go back far enough to look at 1921-1942. So here's the extended inflation graph:

Here's the extended nominal shock graph (with the employment shock model, which works really well):

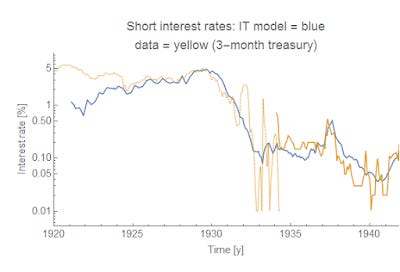

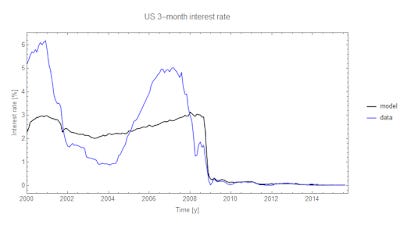

And here is the interest rate model (from the paper) using the 3-month secondary market rate (solid) as well as data form measuringworth.com (dotted):

Unfortunately due to the low resolution of the data, I can't quite see if this mechanism is at play -- that the Fed raised interest rates (see here also) and caused an "avalanche". Raising interest rates (effective monetary tightening) in the run-up to the market crash of 1929 caused the subsequent crash (similar to the effective rise in interest rates in the run-up to the Great Recession), like an airplane stalling to lose altitude.

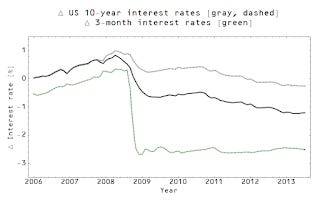

Here's a graph of that more recent effective rise in interest rates:

And the tightening by the Fed started happening as early as the 1920s, much like the Fed tightening starting in the mid-2000s.

...

Update 14 April 2016

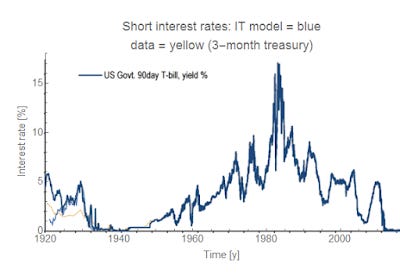

I finally found a source for this this older data and was able to make some better graphs (instead of a cheesy overlay) in both log and linear scales:

...

PS [old charts from 13 April 2016]

I did find some data from here that I've overlaid on the interest rate model graph above:

And here's a zoom in on the relevant piece:

What is interesting to me is the piece where the interest rate exactly follows the rising segment of the model output from about 1925 to 1929. That's very similar to the result for the years before the Great Recession, albeit at a much steeper rate:

I'm still looking into this, but the avalanche model where the Fed piles snow on the mountain by tightening policy, creating a bubble and raising GDP above its "natural" rate is looking pretty good.