Granger causality is an information equilibrium model

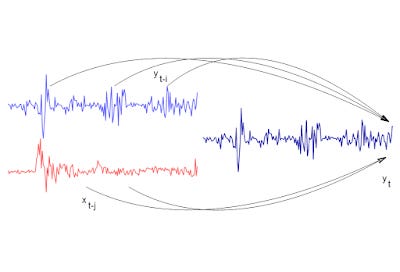

Information equilibrium relationship between Yt and its lagged values Yt-i and the lagged values of the second variable Xt.

In the continuing discussion with Mark Sadowski, I've realized that Granger causality between log-linear variables is equivalent to an information equilibrium model. Let's posit the equilibrium (so direction of the arrow doesn't matter) markets:

$$

Y_{t} \rightarrow Y_{t - i}

$$

$$

Y_{t} \rightarrow X_{t - j}

$$

So that in general equilibrium

$$

Y_{t} = \prod_{i = 1}^{m} \left( \frac{Y_{t-i}}{Y_{0}^{(i)}} \right)^{a_{i}} \prod_{j = p}^{q} \left( \frac{X_{t-j}}{X_{0}^{(j)}} \right)^{b_{j}}

$$

This is the information transfer model depicted in the diagram at the top of this post. If we log-linearize we have:

$$

\log Y_{t} = \sum_{i = 1}^{m} a_{i} \log Y_{t-i} - a_{i} \log Y_{0}^{(i)} + \sum_{j = p}^{q} b_{j} \log X_{t-j} - b_{j} \log X_{0}^{(j)}

$$

$$

y_{t} = a^{(0)} + \sum_{i = 1}^{m} a_{i} y_{t-i} + \sum_{j = p}^{q} b_{j} x_{t-j}

$$

where $y_{t} = \log Y_{t}$ and $a^{(0)}$ represents the collected constant terms. The method of a Granger causality test is then first fitting the models $Y_{t} \rightarrow Y_{t - i}$, and then using the results to fit the combined models $Y_{t} \rightarrow Y_{t - i}, Y_{t} \rightarrow X_{t - j}$ (as well as looking at the reverse structure with $X_{t}$ as the information source).

Mark Sadowski's series of posts (all linked here) can then be summarized as:

monetary base → price level

monetary base → industrial production index

monetary base → TIPS (5-year breakeven)

monetary base → DJIA

monetary base → ten-year rate

ten-year rate → industrial production index

monetary base → exchange rates

monetary base → deposits

monetary base → credit

using the notation source → destination. The markets monetary base → price level ($MB \rightarrow P$), monetary base → TIPS ($MB \rightarrow (d/dt) \log P$) and monetary base → ten-year rate ($MB \rightarrow r_{10y}$) both make the mistake of looking at a market as supply transferring information to the price instead of the price functioning as the detector of information transfer and are better represented as the markets:

$$

P : NGDP \rightarrow MB

$$

$$

(r_{10y} \rightarrow p) : NGDP \rightarrow MB

$$

where $p$ is the price of money. The price level is the price in the market for nominal output and the interest rate is in information equilibrium with the price of money in the market for nominal output. The residuals are even lower if $M0$ is used instead of $MB$ in the above markets. The monetary base is best used in the short term (e.g. 3 month) interest rate market:

$$

(r_{3m}\rightarrow p) : NGDP \rightarrow MB

$$

Here are the results for the long and short interest rates for the US and UK, for example:

So when Mark says:

But as we have seen here there is really is no monetary transmission channel that works primarily, much less exclusively, through expected short-term interest rates.

(even though he does not present an analysis of the monetary base and short term interest rates -- which will be forthcoming from me), we can take the model $(r_{3m}\rightarrow p) : NGDP \rightarrow MB$ as evidence of the large class of models [1] excluded from his analysis.

Additionally, the market monetary base → exchange rates is also incorrect as exchange rates are better represented straightforwardly as the ratio of the prices of money for the two countries in the markets

$$

p_{1} : NGDP_{1} \rightarrow M0

$$

$$

p_{2} : NGDP_{2} \rightarrow M0

$$

$$

X_{1,2} = \frac{p_{1}}{p_{2}}

$$

The monetary aggregate can be various aggregates like M1 or M2 as the data does not really pick one over the other.

Maybe the information transfer framework is the wrong way to think about economics. However, if it turns out to be a correct theory of macroeconomics, then most of Mark's analysis represents spurious correlation as he has set up the flow of information incorrectly.

...

Update 8/10/2015

Corrected sign error and changed figure for the US per Tom Brown's comment below. Thanks for catching that!

Footnotes:

[1] Funnily enough, Scott Sumner's model of expectations is also excluded because if the reason the price level hasn't risen massively due to QE is that monetary base is expected to vanish, MB should have no impact on other variables -- changes in MB should not Granger-cause anything. If changes in MB does Granger-cause other variables and we take that model seriously, then Scott Sumner's expectations theory is wrong.