GDP in the UK

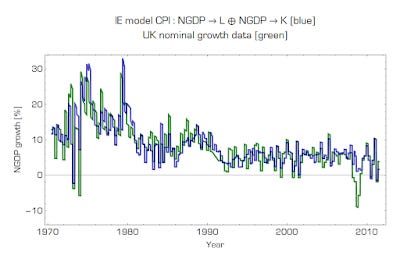

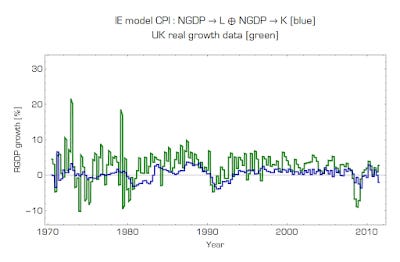

Except for the price level of capital being strange (and not saying it really is the price level of capital anyway, so I used the GDP deflator), this is a run of this model for the UK. It does reasonably well (at least better than this model, which doesn't work at all), but misses out on the great recession. Maybe it was more concentrated in the financial sector in the UK? Maybe it was more non-ideal information transfer than in e.g. the US? (These two questions are related in the IE model.)

Overall, for such a simple model, it does well:

The model is:

CPI : NGDP ⇄ L

X : NGDP ⇄ K

The X is an irrelevant price in the capital market. We can solve these markets for the general equilibrium (as in the paper):

NGDP = n0 (L/l0)ᵝ (K/k0)ᵞ

CPI ≡ dNGDP/dL = (n0/l0) β (L/l0)ᵝ⁻¹(K/k0)ᵞ

The information transfer indices are empirically β = 0.4 and γ = 1.0 (compared to the US, which were β = 0.8 and γ = 0.7).

...

Update 21 January 2017

Another more recent post on this same model is here.

Update

Model errors (inflation is biased high, meaning RGDP is biased low):