A return to deflation in Japan wouldn't be out of the cards

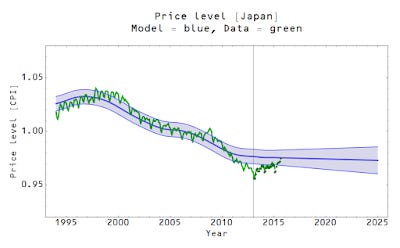

Tyler Cowen is puzzled by deflation in Japan, Scott Sumner replies and says there's no puzzle (looking at core inflation). It would be really nice if either of them could give a graph with a line and maybe some error bands where they'd expect inflation (or the price level) will be. Like this:

That's the latest update of the core CPI price level in Japan (the last update is here).

The question is why is this happening? Japan is still printing physical currency (M0) at an average rate of between 3 and 4% per year and averaging a few percent nominal growth. Cowen seems to blame credibility (and low velocity).

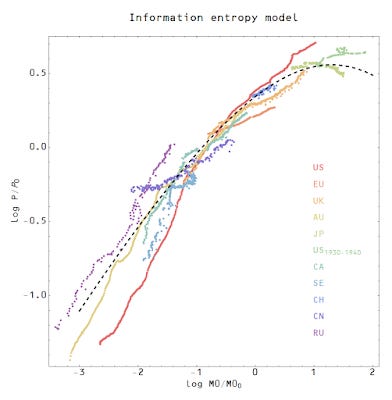

In the information transfer model, this is actually a long run trend across all economies:

And it points to the existence of an "economic temperature" that goes as 1/log M0. There is more discussion in my draft paper (the section on statistical economics), but in general as economies grow the most likely state for a given Yen (or Dollar or Pound) is facilitating a transaction in a low growth market. Eventually the information content of a Yen of money is equal to the information content of a Yen of output.